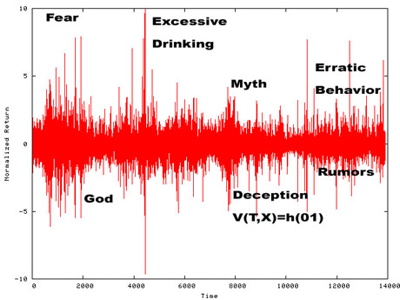

There’s a saying on Wall st that goes something like this, ‘everything must go up until it must go down.’ Of course how fast it goes down depends on the speed of the door hinges creaking as the football field flocks out the gates in pandemonium. With the recent allegations of fraud against Investment and trading bell weather house Goldman Sachs the market is suddenly being forced to digest its recent ethos that runs somewhere along the lines- ‘take as much as you can off the buffet table until somebody high up the food chain eventually complains.’

This might all seem too nebulous given most of us have little or no appreciation of such scary monsters, but that is a shame because what goes on at Wall St is just a microcosm of the iconoclast elite society that most of you aspire to be part of. A part of the world where you have very little chances of making it in these days except if you become a vocal lottery reality star contestant.

For the rest of you there are roving carrot sticks that come and go just when you think you have made it, which is confusing until you realize the system is jigged and set up to perpetually taunt you. The idea is to keep you coming back to the metaphorical casino because in America everyone always so we have been told has a winning chance. Never mind the fact that the casino is always by mathematical design the house favorite and long term winner. And if occasionally the math doesn’t quite work out there’s lobbying that is carried out to circumvent laws that are suppose to address transparency, which in essence stacks the odds against the consumer even if the new TV jingles promise otherwise.

The only time the casino is ever willing to give something away is when it knows it’s about to rot away, which is kind of what it did in the beginning of 2008 when it realized it was getting too difficult to breathe in all the shmaltz starting to drench the midnight air…and it started selling synthetic assets that an astute investor if he had known what Goldman Sachs secretly knew would have walked away.

By fall of 2007/2008, things were starting to now get shaky, credit defaults were starting to rise (that is when you can’t get round to paying people money you owe them back…), industry wasn’t quite making the type of money analysts said it needed to make, and that the thing we like to call risk premiums in various financial instruments were beginning to creep up. Of course most of you ignored it because the TV man implored you to keep buying, that the economy was strong and Santa Claus still loved your kids.

While most of you did just that a bunch of guys called ‘wiener breath’ and ‘small dick’ in high school were now sitting in cubicles 3 miles up in the air wondering why the air up there was starting to stink. They did a few math calculations, made a few phone calls, found out that cab drivers thought the Dow Jones would go to 90 000 by next week and that many of them owned 17 houses in wonderful places where nobody lived or had a living wage.

Of course it wasn’t just the cab drivers who were being greedy, but all the other funds chasing anything

The Tea tastes fruity today. I love it.