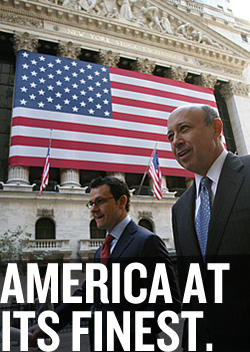

Blaming traders for tainting blue ribbon images.

Blaming traders for tainting blue ribbon images.

Interviews with nearly 20 current and former Goldman partners paint a portrait of a bank driven by hard-charging traders like Mr. Blankfein (the current CEO of Goldman Sachs) who wager vast sums in world markets in hopes of quick profits. Discreet bankers who give advice to corporate clients and help them raise capital — once a major source of earnings for Goldman — have been eclipsed, these people said.

MMh- hard sought wagers, profit above image? Is this new face of Goldman exactly tolerable to the bankers who for generations before traders suddenly became the extended penises of the universe gave the word power and prestige a whole different meaning?

Discreet bankers who give advice to corporate clients and help them raise capital — once a major source of earnings for Goldman — have been eclipsed, these people said.

But it gets better;

With the traders ascendant, Goldman’s bankers are being urged to generate bigger profits. In what former partners called a significant shift, Goldman now uses “profiles” to track how much money its bankers are bringing in.

But money never knows doubt. Continues the NY Times;

But even Goldman concedes it is changing with the times. “This business is all about serving clients, and if you don’t evolve, you die,” said Lucas van Praag, a Goldman spokesman.

In the end one can see the caviar finally been removed from the dining room table and being replaced by lots of pepperoni and if that helps the boys at Goldman Sachs stay fat and rich keep expecting them to eat hordes of eat it too.

As Goldman Thrives, Some Say an Ethos Has Faded – NY Times