Using apps for better financial planning in 2024. Addressing debt, retirement, savings plan and the tools at your fingers to realize your financial goals.

Financial planning is something many people struggle with. And with today’s problems, money matters can get worse. This is where you need to step in and take back some control of your money before it begins to control you. Fortunately, there are a ton of things you can do to get your cash back in order and even begin to secure a better future for yourself and the family. From planning a budget that works to spending less cash, here are some suggestions.

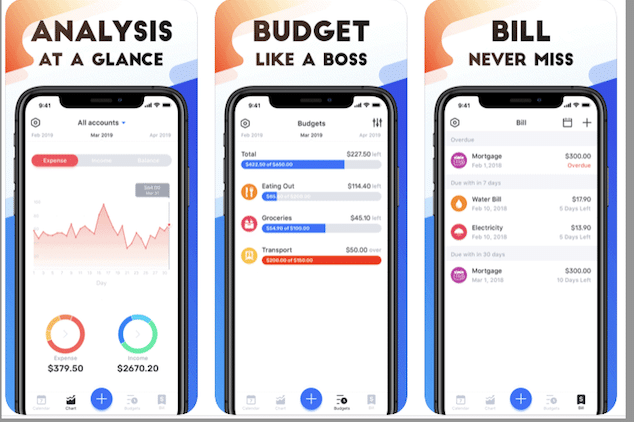

Get Help from Financial Apps

There are apps for pretty much anything you can think of. Given that finances are so important, there are many apps for managing money. From using the best money transfer to India to cut expenses to automatically rounding up card payments, some tools are powerful and can help you manage money better. Online banking is also a great way to see where you stand. Banks offer payment trackers and alerts, and you can view income and expenses in QuickBooks.

Go Over Your Budget

Knowing your budget has a huge impact on managing money. It helps to know the dates of income and outgoing payments and where the money comes from. These can help form a clear picture of your budget, which makes future planning much easier. Try the following to begin with:

- Organize payments by gathering statements, bills, and other documents.

- Understand how much income you have and disposable cash after bills.

- Prioritize spending on utilities, food, and tax before spending any money.

- Go over your budget now and then to see where you can make changes.

Gathering as much data as possible makes budgeting easier and helps with important expenses such as taxes. However, things change, and what works for one month or year may not work for another. So, review and adjust your budget once in a while when things might change.

Financial Planning and Debts

The stress of owing money can be overwhelming, and the effects can snowball. The worst thing you can do is borrow to pay something off, and this can be a hard pill to swallow. It hurts, but sacrifices must be made to pay off debts. But once you get the monkey off your back, the relief is amazing. And you aren’t alone, so never feel bad about debts. A survey by Intuit found that many people get into money trouble, and around 60% don’t know how much they spend.

Create an Emergency Fund

You may not even have enough money to pay debts or bills, but if there is one thing you need, it is an emergency fund. Anything can happen at any time, and you must be prepared financially. Even a small amount of $1,000 can be a huge lifeline in an emergency. Saving this kind of money is hard for some. But imagine if you can’t get to work because the car dies or the basement is flooded. You will need that reserve so you don’t spend what you don’t have.

Address Your Credit Report

Credit is not a bad thing, and it can help your life in ways you never imagined. You need a good credit score to buy things in advance and pay them off in installments. And the required scores for many of life’s essentials are getting higher. Working on increasing your credit score shows commitment to lenders when the time comes to buy something important like a safer car or a house. Using credit cards wisely, paying debts, and reducing short-term costs will all help.

Reassess Insurance Payments

Insurance is one of those things we need but don’t like. However, when the time comes, insurance can be a lifesaver. Imagine the TV fell off the wall and hit the radiator below. No heating, cost repairs, and water everywhere. What a nightmare and what a cost. Insurance will take care of that for you. However, you don’t always have to pay top dollar for it. Many insurance firms will allow you to haggle or ask for a reduction in costs if you are struggling.

Create a Retirement Plan

The time comes when you have earned a rest, and you can put your feet up for retirement. But you may not have even considered a retirement plan yet. It’s never too early, and the earlier, the better because you can actively work towards your plan. Consider these for your plan:

- Ensure you find a good pension provider and pay into it what you can.

- Resist the temptation to decrease pension payments or withdraw from it.

- Work out how much money you will need for your retirement to live comfortably.

- Consider how much income you will have once you actually retire and don’t work.

- Consider how to retire, such as at a specific point or taking less work gradually.

- Think about other income streams, such as investments and side hustles.

- Get professional advice from a retirement advisor to work on a solid plan.

Pensions are vital. In the UK, you have a workplace pension that your employer pays into as well. But it’s always a good idea to pay into a private pension. With these and a state pension, you have a better chance of living a comfortable life when you retire and don’t need to worry.

Use AI for Financial Planning

AI is a new technology that made its mark in 2023. And it is being used for all kinds of things these days. You don’t need to understand how AI works to use it, and it can come in handy for many things. A bit like Google, you can simply ask questions, and it will give you an answer. It isn’t that accurate, though, so don’t take investment advice. However, it can be helpful for explaining things that you struggle to understand when it comes to financial planning.

Round-Up Payments for Savings

Savings are vital for ensuring some kind of financial security, whether short-term or long-term. It can be hard to save sometimes, though. A good trick is to round up money from purchases. So, when you buy something for $5.60, round it up to $6. That’s 40 cents you just saved. These are small and don’t seem like much. But over time, they add up to significant sayings. You can put cash in a jar, and there are apps that can do this for you when you buy using a bank card.

Consider Asking for a Raise

You may not be comfortable with this one, and many people aren’t. However, there is no reason why you can’t ask for a raise if you are a hard worker. The timing might need some finesse, such as after completing a hard task or project. But managers often expect this, and some firms budget for it. With the costs of everything rising more than ever, now might be a good time to consider requesting an increase in pay. Even a small raise can help smooth things over.

See Your Bank About Financial Planning

Banks might be disappearing a little as we all use online services and ATMs. But a bank can be a massive help because it has trained experts in financial management. You can always request a meeting with your bank manager. And around 2.5 billion people globally don’t take advantage of the services a bank can offer. A bank manager can assist you with making budgets and plans and offer advice about using different types of savings accounts and other financial services.

Try to Spend Less

Of course, one way to stay financially healthy is to spend less. This isn’t as easy as it sounds, and you will have to make sacrifices. But often, there are things that can be done and things you won’t miss. To begin spending less money, begin with these simple but effective changes:

- Make a budget and stick to it as best you can and avoid impulse.

- Try dry shopping online, where you add to the basket but don’t buy anything.

- Plan your weekly meals and shop for food based solely on what you need.

- Cancel subscriptions that you don’t need or hardly ever use, like Apple TV.

Dry shopping can help curb the negative financial impact of a shopping addiction. Shop online as you normally would, but don’t actually buy the stuff. Planning grocery shopping is also a big help as it costs much less and provides healthy and nutritious meals for you and the family.

Set Realistic Goals and Plans

Any goals must be attainable, or you just run around in circles. This also causes added stress when you can’t get to where you want to be, especially when it comes to money. Goals should form part of your overall plan, and consider them when making a budget. You are more likely to stick to the plan when goals are within reach and doable rather than seeming like they are too far away. A simple spreadsheet list is all it takes to get the ball rolling with your financial future.

Summary

Apps and online services can help with financial planning this new year. Services like Quickbooks can help you with debts, taxes, and tracking income and expenses. And it’s never too early to work on a retirement plan. Just make sure any goals you set are within reach.