GameStop GME shares plummet after Robinhood blocks WallStreetBets Reddit traders in a bid to contain volatility. Move leads to accusations of manipulation and questions of how the financial markets actually work and the risks that could extend to main street.

Define market manipulation? Video game retailer GameStop (GME – as traded on the NY Stock Exchange) shares tanked on Thursday after trading app Robinhood restricted purchases following a staggering rally driven by Reddit users buying the stock in a kind of group trade in a bid to force the hand of hedge funds that had heavily bet against it – and lost.

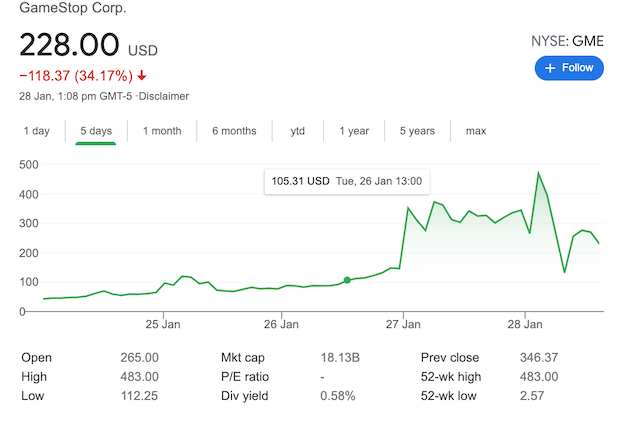

At 11.25am, GameStop shares were down 60 percent, at $116.27 after earlier hitting $500 in pre-market and having closed at $265 the day before (and trading as high as $345 intraday). Still, buyers who had clambered onto the stock last week when the stock had been trading at $17 had ‘Do Not Sell’ trending on Twitter as they urged amateur traders to hold on to the stock, which had rallied 1,700 percent in the month of January.

Amid the buying frenzy, and calls for regulation/oversight following large notable hedge funds being caught on the wrong end of the trade (who usually rule Wall st with little calls for regulation on their end) in recent weeks, online brokerage facilitators of Reddit traders who organized under the sub-reddit — WallStreetBets — seemingly capitulated to financial analyst claims that the retail investors had manipulated the market.

Come Thursday, trading apps Robinhood and Interactive Brokers halted the ability of users to purchase new shares of GameStop on the mobile app, drawing outrage from the Reddit group that has touted the stock and the stock price of GME, crashing off its highs. By midday, the stock had bounced off its lows of $126 and was trading in volatile terrain at $259.

The online app brokers also halted buying for shares of other equities it deemed ‘volatile’ -including theater chain AMC, BlackBerry, retailers Express and Bed Bath & Beyond, headphone maker Koss, swimwear line Naked Brand Group, and Nokia. Equities which in recent weeks had been facing downward draft. The measure served in the immediate to only exacerbate volatility.

Probably the best clip I’ve seen on the gamestock thing so far pic.twitter.com/t1YhxC4MGU

— Joshua Potash (@JoshuaPotash) January 27, 2021

You guys understand this is beyond a movement.. this is a new normal.

The market is not going anywhere.

We have shown that if we want a stock we will buy it & maximize the return.

Exact same things hedge funds do to make BILLIONS.

💯

— Reddit Trading 🚀 (@reddittrading) January 28, 2021

David vs Goliath

Robinhood is one of the biggest of the easy access trading apps, and its popularity spurred the growth of the WallStreetBets community of amateur traders.

The company responding to its decision to limit new buying in GME and other ‘volatile’ stocks said in a statement that it was ‘committed to helping our customers navigate this uncertainty.’

‘We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only,’ Robinhood said.

‘Our mission at Robinhood is to democratize finance for all. We’re proud to have created a platform that has helped everyday people, from all backgrounds, shape their financial futures and invest for the long term,’ the company said.

Adding, ‘We’re committed to helping our customers navigate this uncertainty. We fundamentally believe that everyone should have access to financial markets.’

The interventions led to fury from members of the Reddit forum WallStreetBets, who had spearheaded a campaign to drive up GameStop shares in a battle against hedge fund short-sellers, who they had gone after after the stock was deemed to have been oversold by followers, and forcing professional gamblers’ hand after collectively going long.

‘Leaving robinhood in protest when this is over. Others should do the same,’ one Reddit user wrote. ‘Maybe they will get scared of our power. This is our boat now.’

Sorry for the language on this but portnoy is justified in it. Portnoy for president! #wallstreetbets #reddit #robinhoodlawsuit #robinhood #Citadel #GameStock #GMEtothemoon arrest these people TODAY! https://t.co/Iguetpfe1w

— Matt Anderson (@Manderson825) January 28, 2021

Who exactly does the stock market work for?

Others filed complaints with the Securities and Exchange Commission, accusing Robinhood of attempting to ‘crash’ stocks and ‘cost retail investors millions.’

Reddit users responded calling for a class action lawsuit against Robinhood, posting ‘allowing people only to sell is the definition of market manipulation.’ Others encouraged other investors to hold their positions, reasoning that Robinhood and other brokers sought to incentivize users to sell their stocks to bring GameStop and other surging stock prices down.

Also joining the fray was famed Barstools founder, David Portnoy who blasted Robinhood, accusing the company of siding with the Wall Street establishment over ordinary people who are just trying to get rich.

Posted Portnoy: ‘And it turns out @RobinhoodApp is the biggest frauds of them all. “Democratizing finance for all” except when we manipulate the market cause too many ordinary people are getting rich.’

The ‘David vs Goliath’ type war between amateur small investors who had banded on the sub-reddit vs the professional capital class began last week when famed hedge fund short seller Andrew Left of Citron Capital bet against GameStop and was met with a barrage of retail traders betting the other way and ‘squeezing’ shorts.

Forced to cover margin calls against their short bets, hedge fund players, including Gabriel Plotkin of Melvin Capital and Loen Shaulov of Maplelane LLC suffered massive losses in the billions while small investors who had forced the hedge funds’ hands, made millions (at least on paper).

It’s hard to find market manipulation more flagrant than this, but since it’s being done to protect the wealthiest and most powerful — Wall St oligarchs who own and control the establishment wings of both parties — it’s very hard to imagine the government treating it as such: https://t.co/VJnXpMAqkJ

— Glenn Greenwald (@ggreenwald) January 28, 2021

American capitalism under the microscope

On Twitter, the movement spread on Thursday, with the phrase ‘DO NOT SELL’ trending, urging people who had bought GameStop to hang on to the stock. While others wondered who would be left to buy in what some wondered began to resemble a pyramid scheme, with the stock ripe for capitulation once followers sought to unwind their trades with no waiting buyers. And worse a general sell off for those players who had gone long the market on margin – an echo of what had led to the great stock market crash of 1929.

Regarded by market professionals as ‘dumb money’, the pack of amateur traders, some of them former bankers working for themselves, has become an increasingly powerful force worth 20 percent of equity orders last year, data from Swiss bank UBS showed.

The campaign effectively sent the GameStop’s shares up by 1,700 per cent in four weeks, with three of its largest individual investors gaining more than $3 million in net worth during the stock’s staggering rally.

The series of events has reignited discussions of the efficacy and morality of the capital markets which some argue had morphed into a speculative gambling bubble devoid of the real world.

The consequences of such trading and how the capital markets can up-end main street, includes short sellers’ ability to materially affect workers and managers at the equities should professional gamblers force the hands of such outlets. Professional gamblers who for once had the tables turned on them, as the public cheered, while others wondered about the roller coaster nature of the financial markets and players’ ability to impart grave consequences to the detriment on main street as had been previously manifested in the subprime mortgage crises of 2008 which saw a world depression and many home-owners dispossessed of their homes.