International vaping brands seek to pounce on market demand where JUUL failed to deliver or capitalize as market, regulatory guidelines and nation specific issues plague larger vendors.

In 2019, the United States vaping industry experienced its first significant period of decline after years of rapid growth. Starting during the summer, a lung disease caused by vaping swept through the country and made more than 2,000 people seriously ill.

The disease was caused by adulterated THC vaping products derived from marijuana – not nicotine e-liquids – but news reporters conflated the two types of vaping in nearly every report about the lung illness, creating a sense of panic among vapers. Some e-cigarette users returned to smoking, and many smokers who might have switched to vaping decided not to switch after all. With full FDA regulation fast approaching, it’s unsure whether the American vaping industry will ever fully recover.

As of January 2020, nearly two thirds of Americans incorrectly believed that nicotine e-cigarettes – not THC products – caused the lung illness.

The negative press toward vaping hit JUUL – the world’s biggest e-cigarette brand – hardest of all. By the fourth quarter of 2018, tobacco giant Altria had written down its investment in JUUL by billions of dollars.

In the JUUL camp, the general mindset was that the downturn in sales was little more than a temporary speed hump. The company was already executing its plan for worldwide expansion, and within a few years – maybe less – international sales would be just as important as domestic sales for JUUL, if not more so.

A funny thing happened, however, on the road to world domination. In one international market after another, buyers looked at JUUL and decided that they weren’t interested. The New York Times reported on Monday that JUUL has pulled out of several international markets – or delayed launching in certain markets – because the anticipated demand hasn’t materialized. International vaping brands like V2 E-Cigarettes UK couldn’t be happier.

If things couldn’t get worse, the US Federal Trade Commission on Wednesday sued to undo tobacco giant Altria’s $12.8 billion investment in Juul over concerns that the two companies illegally quashed competition in the e-cigarette industry.

“Altria and Juul turned from competitors to collaborators by eliminating competition and sharing in Juul’s profits,” Ian Conner, director of the FTC’s Bureau of Competition, said in a statement.

So, what’s happening? Why have JUUL’s plans for local and world domination proved so difficult to execute? Let’s look at what the response to JUUL has been like in what might have been some of the company’s largest markets.

United Kingdom

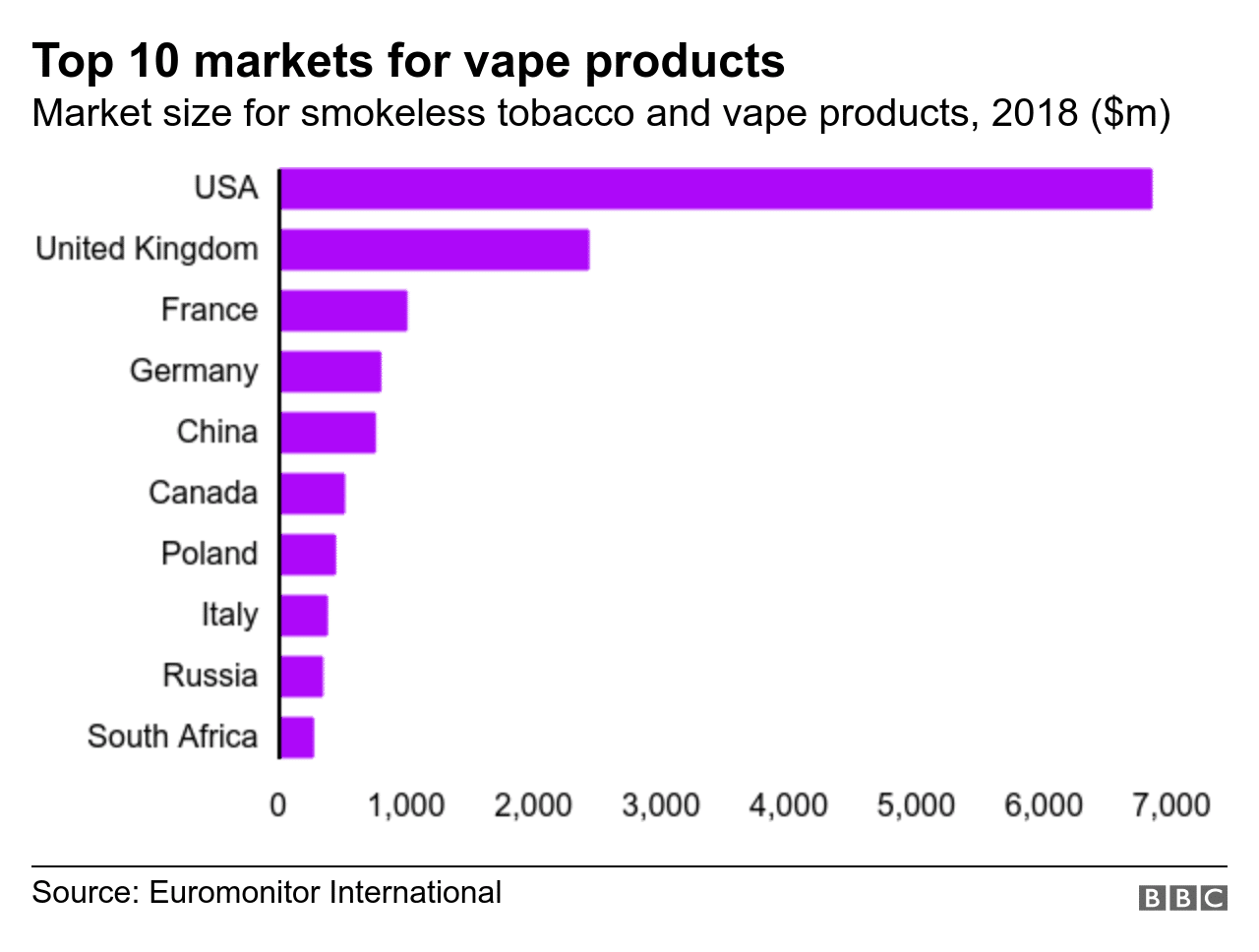

After the United States, the United Kingdom is the world’s second largest market for vaping products. The country’s public health system actively supports vaping and considers it a viable quit option for smokers. The regulatory climate for new vaping brands in the United Kingdom is also quite favorable; brands can launch there without worrying about an undue amount of red tape.

The problem for JUUL in the United Kingdom, however, is that the company can’t sell its products there at the same ultra-addictive nicotine levels as in the United States. In the United States, JUUL’s standard nicotine level is a whopping 59 mg/ml. That gives JUUL about the same satisfaction level – or addictive potential, one might say – as a tobacco cigarette. In the United Kingdom, though, a law called the Tobacco Products Directive limits the nicotine strength of all e-liquid to a maximum of 20 mg/ml.

JUUL can’t play to its biggest strength in the U.K., so the brand hasn’t created many new vapers or encouraged many existing vapers to switch brands. Without the ability to sell its extremely potent nicotine salt e-liquid, JUUL is essentially the same as other e-cigarettes in the United Kingdom but with a much higher price.

https://youtu.be/XW4duMgxEIo

India

Not long ago, JUUL executives thought that India represented one of the brand’s biggest opportunities for explosive growth. Tobacco use in India is rampant, with around 106 million adults using cigarettes, bidis or smokeless tobacco daily. With such a large population of tobacco users, India would surely be a profitable market to enter. JUUL began to allow products to trickle into the country as early as 2017 and planned a wide-scale launch for 2019.

As the planned launch approached, though, India banned vaping outright. In implementing the ban, the Indian government cited the concern that teens in India would find JUUL appealing and would begin vaping, as has happened in the United States. Anti-tobacco activists pointed out that most Indian tobacco users can’t afford machine-made cigarettes and therefore wouldn’t be able to afford JUUL, either. Only the affluent – and the children of the affluent – would be likely to buy the product. Most Indian tobacco users buy bidis – which cost much less than cigarettes – or use a smokeless blend of tobacco and betel nut called paan.

https://youtu.be/VJ_8BQWyHSc

South Korea

Things looked great for JUUL when the company entered the Korean market in May 2019. Korea has plenty of affluent people who love gadgets, and JUUL’s launch was met with immediate interest from consumers. As in the United Kingdom, Korea has laws that sharply limit the maximum nicotine strengths that vaping brands are allowed to sell – but people happily bought JUUL’s products anyway.

Korean sales of all e-liquid products peaked at nearly 10 million pods sold in the third quarter of 2019, but sales dropped by 90 percent during the fourth quarter of the year.

JUUL experienced a sudden and drastic decline in e-liquid sales due to a report in the media claiming that at least one of JUUL’s Korean pod flavors contained Vitamin E acetate, the same ingredient linked with the vaping lung illness that swept through the United States in 2019.

While JUUL denied using Vitamin E in any of its pods, the report was incredibly damaging to all brands in the Korean vaping industry. Demand for pods and bottled e-liquid dried up seemingly overnight. People who continued to vape began to believe that other people were looking down on them. Owners of vaping businesses blamed JUUL for the negative publicity and felt that the brand had brought down the entire vaping industry.

Many Koreans who used to vape have since turned to other harm reduction options, such as the IQOS smoking system from Philip Morris. IQOS heats tobacco rather than burning it, so it releases fewer toxic chemicals than combustible cigarettes. The Korean market is also ideal for IQOS. While the government limits e-liquid nicotine strengths to minimally addictive levels, heat-not-burn systems like IQOS are perfectly legal and deliver the same nicotine kick as cigarettes.