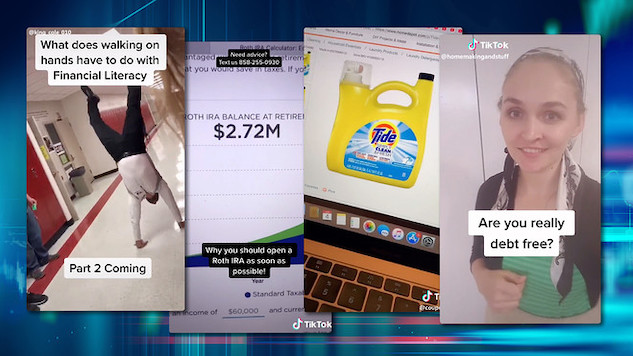

MoneyTok: financial resource for teens and young adults on video social media app as platform continues to grow in popularity. Knowing your financial hashtags.

TikTok may be a popular social media app best known for its viral dances, but it’s quickly becoming a financial resource for teens and young adults.

For those who don’t have the app downloaded to their phones — generally, anyone over the age of 40 — TikTok is an app where users post short videos. The most popular videos show people lip-synching or dancing along to songs, but the app has grown to include a variety of entertainment-based content.

Now boasting 689 million users worldwide (monthly), TikTok has exploded in popularity since it debuted in 2016. Many of these users scroll through the app to find memes, watch roller skaters twirl, or listen to sea shanties, and a growing number of people are searching for financial answers on the app.

Know Your Financial Hashtags

The financial community on TikTok falls under many tags. In mid-February, the #moneytok tag has racked up 5.9 billion views and counting, while the #personalfinance tag is following close behind with 3.7 billion views. Other smaller tags such as #financetok, #fintok, and #richtok fall under these broader, massively popular umbrella categories.

Together, these tags catalogue a variety of financial topics, touching on basic budgeting advice and delving into more complex lessons on investing.

Wondering how to use an installment loan or pay off your existing installment loan online? There’s a video for that.

Financial TikTokers address common money questions like the ones above, answering them in quick 60-second videos. Some talk straight to their viewers, but most dance to popular songs as the main points of their argument show up as text on the screen.

Can You Trust Everything You See on TikTok?

Like any other social media app, TikTok has its pitfalls. There’s nothing stopping scam artists from making an account under the guise of sharing budgeting and investing advice to boost their follower count.

While these users may seem like they’re talking a good game, they’re actually sharing potentially dangerous financial techniques in pursuit of views and money. The Vox reports on 10 of the worst instances of misinformation spread on the social media platform here.

For the experienced and financially-savvy, it’s easy to spot fake news. But the problem is that many TikTokers are young people who still have a lot to learn about personal finance. Half of all the app’s users are under 34, while some 41 percent of users are just 16–24.

Data shows that this demographic may not have the financial know-how to differentiate between genuine advice and predatory scams. A new report says just 16 percent of millennials were able to finish a financial literacy test. In another study, 46 percent of Gen Z-ers say they feel uncertain and nervous about managing their finances.

Without a foundation of financial education, taking all financial TikTokers on their word could get these financially vulnerable folks into trouble.

Bottom line

TikTok is a free, accessible app that offers its users a fun, simple way to find financial information. It can be a great jumping-off point for those who want to learn more about how money works, but it shouldn’t signal the end of your financial education.

If you scroll through TikTok for advice about installment loans or investments, cross reference any tip you find on the app and get as many different takes on the subject as possible.

A little investigating will give a serious boost to your financial literacy. But more importantly, it will filter any misleading or dangerous tips before you commit to them with your hard-earned money.