$19 million defrauded: Paul Rinfret Ponzi scheme leads to former Manhasset Wall st trader being sentenced to over 5 years jail. Losses beyond imaginable.

‘I hate myself’. A former Wall Street trader has been sentenced to over five years jail after admitting to defrauding investors of $19 million in a Ponzi scheme along with spending his victims’ funds on a house in the Hamptons, jewelry and a lavish party.

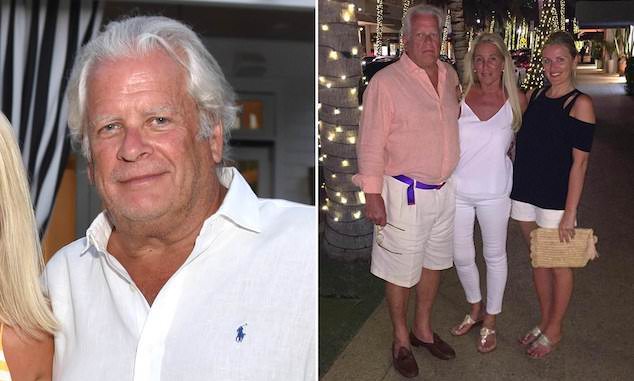

Paul Rinfret, 71, of Manhasset, New York, was sentenced on Monday in Manhattan federal court.

The sentencing followed his October guilty plea to wire and securities fraud.

In court papers, Assistant Federal Defender Jennifer Willis had asked that her client be sentenced to a year in prison, noting that Rinfret’s arrest had led his wife of 44 years to file for divorce, two children to stop speaking with him and to a foreclosure action against his home.

He started his own investment business after the 2008 economy collapse when his employer’s business closed, she said, and some of the first investors were family members.

Fraud carried out from 2016 through 2019

‘He is truly a man who has lost everything,’ she wrote.

U.S. District Judge Gregory Woods in Manhattan said Rinfret should spend five years and three months behind bars.

Prosecutors said he carried out the fraud from at least 2016 through 2019, investing only a small portion of the money he raised from six victims.

The Southern District of New York (SDNY) and Securties and Exchange Commission (SEC) say that he sold limited partnership interests in his investment fund, Plandome Partners LLC.

According to the court documents filed by the SEC, obtained by Manhasset Press, Rinfret boasted to investors that the trading strategy had generated triple-digit returns as high as 362 per cent for Plandome Partners investors over a multiyear period, and that Plandome Partners had never lost money in a single month since 2012. Sound familiar?

Rinfret told investors that Plandome Partners has been using a proprietary algorithm to day-trade S&P 500 futures contracts, state the documents.

But much of the money invested in the company was siphoned off the dailymail reports.

A smorgasbord of luxury expenditures

When he did invest, he lost money but falsified monthly account statements to make it seem as though his investors were enjoying excellent results, prosecutors said.

‘As is my custom of reporting to you after large market moves, I am pleased to announce a 2.15 percent gross gain today,’ Rinfret wrote in a May 17, 2017, email to one of the victims, according to the complaint cited by theislandnow.

At the time of that email, the victim’s money had not been traded at all, the complaint said.

Rinfret’s misuse of his investor’s funds was detailed by the SEC.

They said he used money from investors on a nearly $50,000 Hamptons vacation rental and $35,000 on custom kitchen cabinets.

He blew $170,000 on jewelry, watches and cars; more than $105,000 on wine and other alcohol; approximately $12,000 on cigars; and more than $130,000 at restaurants.

Manhasset resident, Paul Rinfret, arrested for $19 million dollar ponzi scheme https://t.co/eiE1gV8jek pic.twitter.com/VFpBVylKAH

— Manhasset Press (@ManhassetPress) July 12, 2019

Maintained society pretenses

The SEC and the New York prosecutors said he spent tens of thousands of dollars on the Manhattan venue where his son held an engagement party, in September 2017.

The party, at The Water Club – a barge on the East River, off midtown Manhattan – cost at least $30,000, court documents state.

Guests were photographed posing on a red carpet-style set up, in front of a screen with the hashtag: #RinfretAllDay.

Rinfret withdrew almost $570,000 in cash from the Plandome Partners account, including more than $500,000 in ATM withdrawals.

He used his investors’ money to pay for everyday expenses such as dry cleaning, gas, car wash, gym membership, DMV and AAA fees, student loan payments, eye glasses, tanning and shoe store purchases, the Manhasset Press reported.

When he was charged, in July 2019, Geoffrey Berman, the then-attorney for the Southern District of New York, said Rinfret ‘deceived investors at every step.’

He said: ‘He lied about his past returns to get them to invest. He lied about having invested all of their money, when he was actually spending much of it on things like jewelry, cars, and a Hamptons vacation home. He lied about how their money was growing. His alleged lies stop today.’

Rinfret’s wife of 44 years, Denise, an interior designer, filed for divorce.

Two of his children – Amanda, Missy and John Paul – stopped speaking with him, and his home was foreclosed.

SEC is going after Paul Rinfret, who lives w/decorator wife in this Manhasset shack at 99 Bourndale. SEC says he’s a regular Bernie Madoff. pic.twitter.com/J24qSN1ifC

— Roslyn Heights, N.Y. (@roslynheightsny) June 29, 2019

Family unaware of deceit?

His family were unaware of his deceit, prosecutors said.

But there’s more.

Rinfret had been previously sanctioned by the New York Stock Exchange, so he was unable to open an account at a brokerage firm using his own name. According to the court filings, Rinfret used two of his family members names to open an account at ‘Brokerage Firm 3’ and his own name did not appear on any of the documents.

One of the family members that signed documents passed away in or about June 2014, but ‘Brokerage Firm 3’ account statements continued to go to that individual’s address through 2016.

SEC court filings state that Rinfret frequently called ‘Brokerage Firm 3’ on his cell phone after that person’s death and pretended to be the deceased person.

He also used the names of two of his three adult children.

In multiple calls with brokerage firms, he pretended to be his son, John Paul Rinfret – whose September 2017 engagement party he funded – and told the firms that he was only trading his own family’s personal fund, the SEC reports.

The SEC court documents also state that Rinfret transferred at least $845,000 to two companies controlled by his wife; a least $325,000 to John Paul; and at least $675,000 to his son-in-law.

The Rinfret Group, an interior design company based in Roslyn, is owned by Denise and Missy.

‘The owners of the Rinfret Group had no knowledge of how Paul Rinfret ran his business and believed that the money he transferred to The Rinfret Group was legitimately earned,’ said Roger J. Bernstein, an attorney representing The Rinfret Group and John Paul.

‘They are shocked and saddened by what transpired.’

On Monday more than $20 million in forfeiture was ordered, along with over $12 million in restitution.

In a letter to the judge, Rinfret said: ‘I do not offer excuses. I made terrible mistakes for which I have and will continue to pay. All responsibility is mine.

‘I hate myself for the recklessness I showed.’