Gustavo Arnal suicide: Bed Bath & Beyond BBB CFO feared $1.2B stock lawsuit when he jumped to his death after accusations of pump and dump scheme.

A Bed Bath & Beyond exec who plunged to his death on Friday was being sued for artificially inflating the company’s stock price in a ‘pump and dump’ scheme to sell off his shares at a higher price.

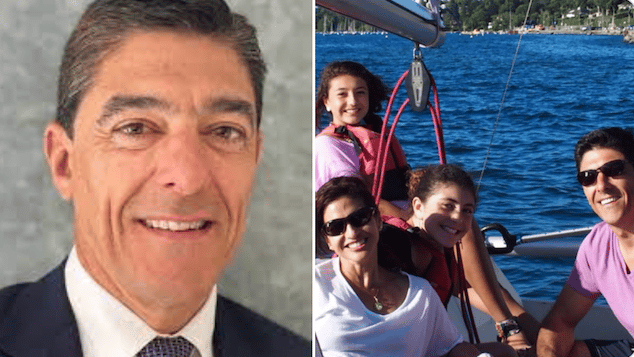

Gustavo Arnal, 52, Venezuelan born executive was facing a $1.2 billion ‘pump-and-dump’ stock-fraud lawsuit when he apparently leaped to his death from his luxury 18th-floor lower Manhattan apartment just after midnight, early Friday morning.

Arnal who was the chief financial officer (CFO) of BBB, was among several defendants named in a class-action suit that accuses him, Chewy.com founder Ryan Cohen and others of artificially inflating the troubled housewares giant’s share price.

The class-action complaint, filed Aug. 23 in a Washington, DC, federal court, alleges that the scheme also involved ‘a classic attempt to spark a gamma squeeze.’

The tactic relies on the calibrated purchase of stock options, utilized during last year’s GameStop stock trading frenzy, according to The Motley Fool.

Illicit gains at the expense of duped shareholders

Cohen, the chairman of GameStop, came under fire last month for making $68.1 million in profits by unloading a stake in BBB that reportedly included 7.78 million shares and options to purchase another 1.67 million.

Cohen’s lucrative 56% gain came about seven months after he first invested in BBB.

On Aug. 16, the same day Cohen cashed out, Arnal sold 42,513 shares of BBB stock worth more than $1 million.

On Sunday, Reuters said its calculations showed that Arnal had actually sold 55,013 shares but didn’t say how much he netted.

The gains came after Arnal, a married father of two daughters, joining BBB in May, 2020 after previously working as CFO for cosmetics chain, AVON, since the spring of 2019. It remained unclear of Arnal had ever been accused of impropriety during his time at Avon.

The bulk of Arnal’s career was spent at Procter & Gamble where he spent over 20 years helping build the consumer staple’s core products growth.

Arnal died Friday in what cops believe was a suicide plunge at 12:20 a.m. from his upscale Tribeca apartment, the ‘Jenga building’ located at 56 Leonard St.

Shareholders suffer $1.2 billion losses

After the disclosure of Cohen’s and Arnal’s stock sales Aug. 17, shares in BBB fell from a ‘record high $30’ to $8.78 on Aug. 23, according to the suit.

The stock closed at $8.63 a share Friday amid disclosures of more than 150 store closures and wide company lay-offs.

In court papers, plaintiff, Pengcheng Si of Falls Church, Va., said she and her spouse bought 8,020 shares of BBB ‘at artificially inflated prices’ between March 25 and Aug. 18 ‘and have suffered realized and market losses of approximately $106,480.’

Total damages to all BBB shareholders, including the company’s interests, were about $1.2 billion as of Aug. 23, according to the suit.

Other defendants in the suit include JP Morgan Securities, which is accused of helping Cohen and Arnal ‘effectuate’ their sales ‘and otherwise launder the proceeds of their criminal conduct.’

BBB, which is named as the lead defendant, is accused of making a ‘materially false and misleading statement’ in an Aug. 18 Securities and Exchange Commission filing that said, ‘We are pleased to have reached a constructive agreement with [Cohen’s] RC Ventures in March and are committed to maximizing value for all shareholders.’

Bed Bath & Beyond exec Gustavo Arnal faced $1.2B stock suit when he plunged from NYC building https://t.co/a33UWP8wpu pic.twitter.com/UGaUptIZ9u

— New York Post (@nypost) September 4, 2022

BBB and co-defendants decline comment on suit

BBB responded over the weekend, stating, ‘We will not comment on litigation and ask that you please respect Mr. Arnal’s family and their privacy at this time.’

It’s unclear if Arnal hired a lawyer before his death, with reports telling of the CFO’s wife present at the couple’s apartment when Arnal leaped to his death.

In a statement posted on its website, BBB acknowledged Arnal’s death and said the company was ‘profoundly saddened by this shocking loss.

‘Gustavo will be remembered by all he worked with for his leadership, talent and stewardship of our company,’ Board of Directors Chair Harriet Edelman said.

Of note, all entities named in the ‘pump and dump’ suit have declined public comment over the weekend.