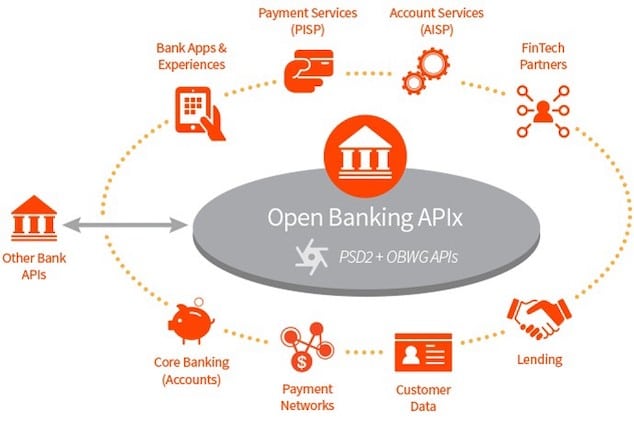

Open banking API as a collaborative way of data sharing. Enabling unaffiliated parties with more customized offers for customers and better market competition.

From an end user perspective, open banking is up-to-date technology that provides way faster and easier usage of personal data in different platforms. Open banking could also be defined as a collaborative way of data sharing, using API. It enables unaffiliated parties to provide more customized offers for customers and creates better conditions to compete in the marketplace.

Unlike any other sectors, banking has been tightly regulated and controlled. Open banking gives indisputable benefits: improves customer experience, creates an environment for new organizations and new revenue streams. From a commercial standpoint, regulated access to data already helped to launch brand new business models and innovative products.

Open banking data faces another challenge. The internet and all the online world have no borders, but banks, financial institutions and other companies that use open banking data must belong to a physical place, country and continent. Different areas have different regulations that can make an impact. For example, the EU has been proactive and updated Payment Services Directive (PSD2) to adapt regulation for open banking data sharing. PSD2 is often called the most programmatic approach in open banking and goes like an example to follow. Nevertheless, other nations have no regulation or regulation is abstract. Global organizations such as Ebay or Google have to synchronize all the regulations from different nations and make it legal and usable in the whole world.

Open banking abolished the line between banks and other financial institutions. Opening account access to non-banks changed the game rules. A customer‘s private information that was processed under a closed bank‘s door before is now accessible not only for Payment Initiation Service Providers (PISP) but also for Account Information Service Providers (AISP). A traditional bank could meet the requirements of PISP, but the concept of AISP was never used before. Account Information Service Providers can collect financial data from all the payment providers and other financial institutions. Collected data could be differentiated and analyzed. AISP provides a wide variety of data analysis tools, but it does not allow people to initiate payments. Some of the organizations could be AISP and PISP at the same time.

Open banking is not the latest update in the financial sector. Even PSD2 was launched in 2018. Open banking applies in many different cases, but there is still enough space to develop it. Solutions have to be tested, completely safe and financially beneficial to apply it in the real world. Banks often look at open banking as a threat and other financial institutions believe that it is an opportunity to compete and take a place in the market. Fintech innovators are rapidly gaining popularity with the new services and products and open banking helps with that, but traditional banks adapt and maintain their relevance.

Open banking and all the functionality differently affects small, medium and global companies. Small and medium web-shops and other e-commerce organizations have an opportunity to apply easier log-ins to their systems and, by using buyer data, possibly shorten the buyers journey to buy. Big international companies must put a lot of effort to manage between different regulations and predict the market to create tools with long-lasting relevance.

Open banking is like a common language that is used to communicate between different financial institutions. Regulations and directives made clear understanding what is legal and what is forbidden. Private business developers as much as government systems developers try to prevent any possible data leak and give the best experience for the end user. Data sharing is one of the open banking functions, but in general, open banking is much more. That’s the mixture of law-based decisions, adapted in the IT sector to share private data between financial institutions to meet user’s needs and create new products.